Whenever people think of investments, they think of popular property classes such as alternative investments, cash, bonds, REITs (Real Estate Investment Trusts), and commodities. However, as any experienced investor would tell you, it is best to have a multi-faceted investment portfolio to limit exposure to a single kind of property. It would also lower the liability of your portfolio with time.

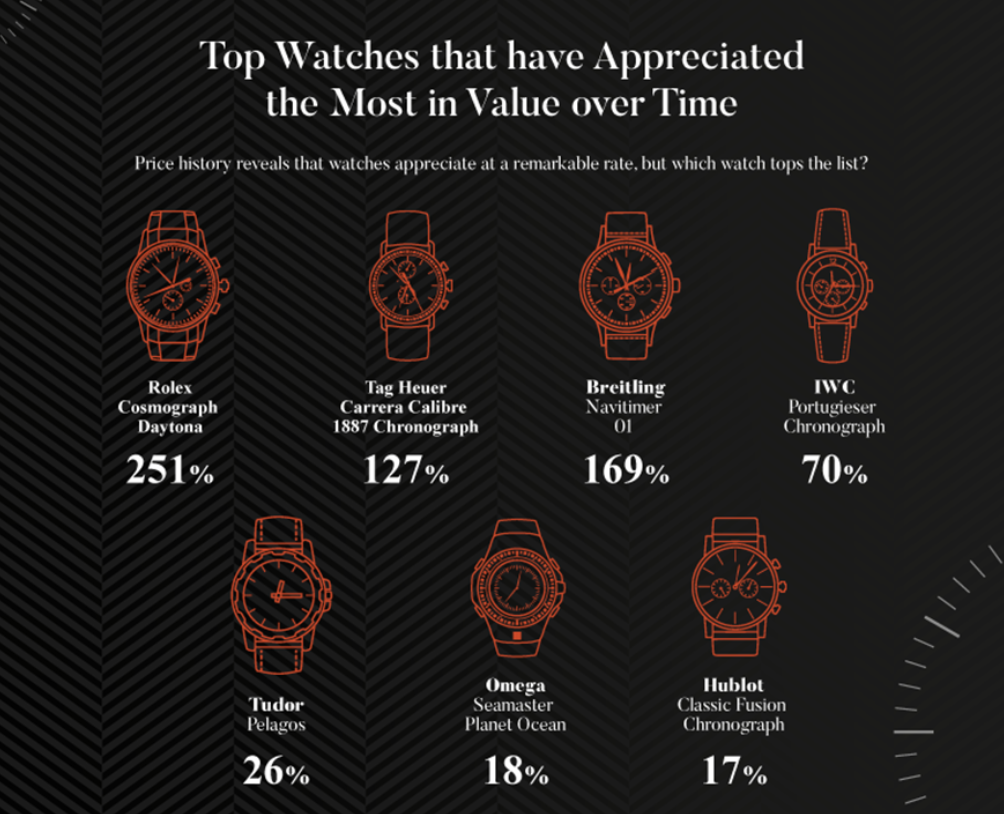

In the unpredictable world of high-end watch collecting, in-demand classic items from brands such as Rolex, Patek Phillipe, Omega, and Audemars Piguet have high prices. In a few cases, their costs have gone up twice their value in one or two years. However, here’s what you must know before adding this property class to your existing investment portfolio.

(Graphic: Betway Casino)

Should I Invest in High-end Watches?

When investing in high-end watches, capital appreciation brings forth your investment returns. However, just like making investments in antiques, sneakers, or art, you must understand the market to make a profit. Similar to luxury bags such as Hermès Birkin or Chanel, luxury watches have underlying values. Consequently, they are in demand for high-end products that have been shown to retain the value paid for them even in the future. Particularly, the watches from renowned brands, including Vacheron Constantin, Audemars Piguet, Rolex, Patek Philippe, and Jaeger-LeCoultre have maintained their value in the secondhand market.

If you service a good watch routinely, it should hold its worth. These pieces also have sentimental value and are seen as a status symbol. It is the reason some collectors purchase and hold on to pieces in an economic crisis. Collectors with prestigious timeless pieces are less likely to put them up for sale due to a price crash or panic. The Rolex Daytona wore by Paul Newman, a legendary Hollywood actor, and race car driver, was auctioned for $17.75 million in 2017 in New York at Phillips auction house.

However, before getting all too excited, you must know that not all watches sold at an auction will automatically grow in value. Only a selected couple of watches may appreciate in value at least twice or thrice in the short-term. Most of the high costs are fueled by the hype and speculation surrounding particular models. There are a few risks connected with investing in high-end watches.

Risk Linked to Purchasing Luxury Watches

Like purchasing art, antiques, or sneakers, the value placed on a high-end watch depends on supply and demand, market sentiment, and trends. As a luxury watch investor, you are exposed to the notion of cyclical patterns. It implies that you need to wait for years before your watch becomes stylish yet again. However, analyzing the investment possibility of luxury watches is as complex as the advanced machinery that operates them. You also require a long investment horizon since you may have to

purchase and hold the watch till it grows in value.

The Bandwagon Phenomenon

Just like with stock investments, those investing in high-end watches are susceptible to the bandwagon effects. It is a mental bias where people do things just because others are doing it, putting aside any of their beliefs. It is also referred to as the herd mentality. Apart from the socio-economic and psychological factors, prices for luxurious watches normally increase whenever more investors come on board.

It creates a positive response loop of a rise in prices and the demand growth for a property such as a high-end watch. For instance, a rise in hyped-up watches such as the Omega Speedmasters, Patek Philippe Nautiluses, and Paul Newman’s Rolex Daytona appeals to people. However, you have to ask yourself when it stops.

Be Aware of Counterfeit Watches

Mock-up watches are a challenge when purchasing luxurious watches. Unless you know your way around horology matters, it could be difficult to tell the difference between a real watch from an imitation. The best approach would be to purchase a new piece from licensed dealers. Always acquire your watches from established secondhand dealers if you are purchasing pre-owned watches. Verify your watch’s authenticity from a trustworthy watch store before purchasing your watch from a private seller.

Risk of Property Damage

Damage risk falls within the realm of possibility when dealing with luxury watches. Servicing these watches can cost you anywhere from hundreds to thousands of dollars, based on the kind of watch movement and also the brand. Reconditioning complex movements like tourbillion or chronography will cost you a lot more than an average automatic watch.

5 Signs Your Loved One May Be Developing Alzheimer’s

5 Signs Your Loved One May Be Developing Alzheimer’s